Property depreciation formula

It provides a couple different methods of depreciation. Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken.

Residential Rental Property Depreciation Calculation Depreciation Guru

Number of years after construction Total useful age of the building 2060 13.

. Depreciation is a method for spreading out deductions for a long-term business asset over several years. How to Calculate Straight Line Depreciation. The basic way to calculate depreciation is to.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. This depreciation calculator is for calculating the depreciation schedule of an asset. The straight line calculation steps are.

How to Calculate Rental Property Depreciation. Periodic Depreciation Expense Beginning book value x Rate of depreciation. Depreciation formula for the double-declining balance method.

A Simple Example of Straight-Line Depreciation. It is 275 for residential rental property under the. According to the IRS the depreciation rate is 3636 each year.

For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970. This is the remaining. Heres a quick example of how real estate depreciation for commercial property.

First one can choose the straight line method of. For example rental buildings are classified under Class 1 and must be depreciated at a 4. 100000 cost basis x 1970 1970.

The recovery period varies as per the method of computing depreciation. Determine the cost of the asset. If a certain property that cost 180000 can be depreciated using a tax life of 275 years you would divide 180000 by 275.

In such cases depreciation is arrived at through the following formula. Annual Depreciation Purchase Price - Land. Commercial real estate depreciation acts as a tax shelter by reducing the taxable income of investors.

Subtract the estimated salvage value of the asset from. Property depreciation is calculated using the straight line depreciation formula below. Each asset class comes with its own depreciation rate and calculation method.

Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Property Plant And Equipment Schedule Template Excel Schedule Template Financial Analysis Finance Career

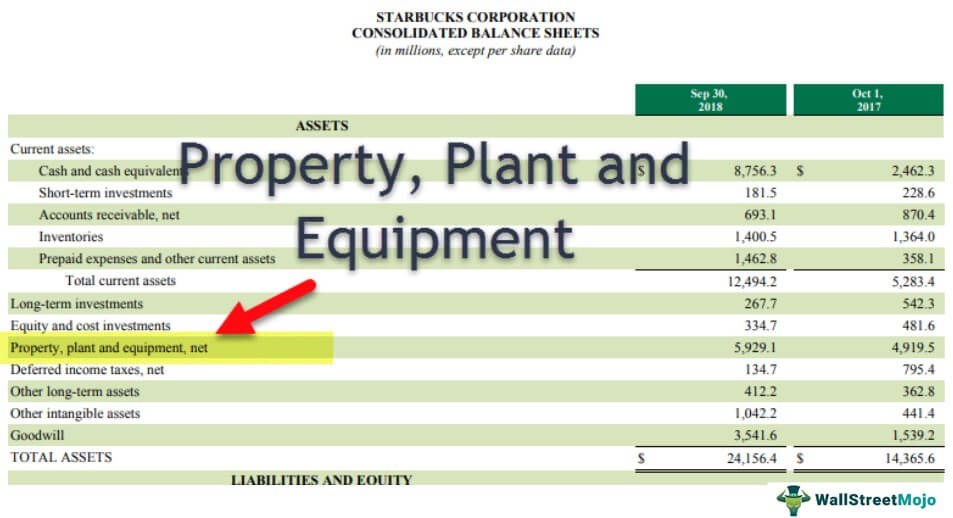

Property Plant And Equipment Pp E Formula Calculations Examples

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Bonus Depreciation Calculator In 2022 Savings Calculator Bonus Real Estate

Depreciation Schedule Template Depreciation Schedule Irs Depreciation Schedule Excel Template Depreciation Formula Depreciation Schedule Pdf Fixed Asse Hubungan

Depreciation Rate Formula Examples How To Calculate

What Is A Property Depreciation Calculator It Helps You To Estimate The Likely Tax Depreciation Benefit Loan Repayment Schedule Investing Investment Property

How To Use Rental Property Depreciation To Your Advantage

Bookkeeper S Cheat Sheet Accounting Education Learn Accounting Bookkeeping Business

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Guide To The Macrs Depreciation Method Chamber Of Commerce

Depreciation Of Building Definition Examples How To Calculate

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Understanding Rental Property Depreciation 2022 Bungalow

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense